The debt-equity ratio can be a valuable tool for evaluating a company’s financial standing, but it’s important to use other metrics as well to get the clearest picture possible. The debt-to-equity ratio does not consider the company’s cash flow, reliability of revenue, or the cost of borrowing money. The debt-to-equity ratio (D/E) compares the total debt balance on a company’s balance intro to bookkeeping and special purpose journals sheet to the value of its total shareholders’ equity. Common debt ratios include debt-to-equity, debt-to-assets, long-term debt-to-assets, and leverage and gearing ratios. Acceptable levels of the total debt service ratio range from the mid-30s to the low-40s in percentage terms. The debt ratio aids in determining a company’s capacity to service its long-term debt commitments.

Role of Debt-to-Equity Ratio in Company Profitability

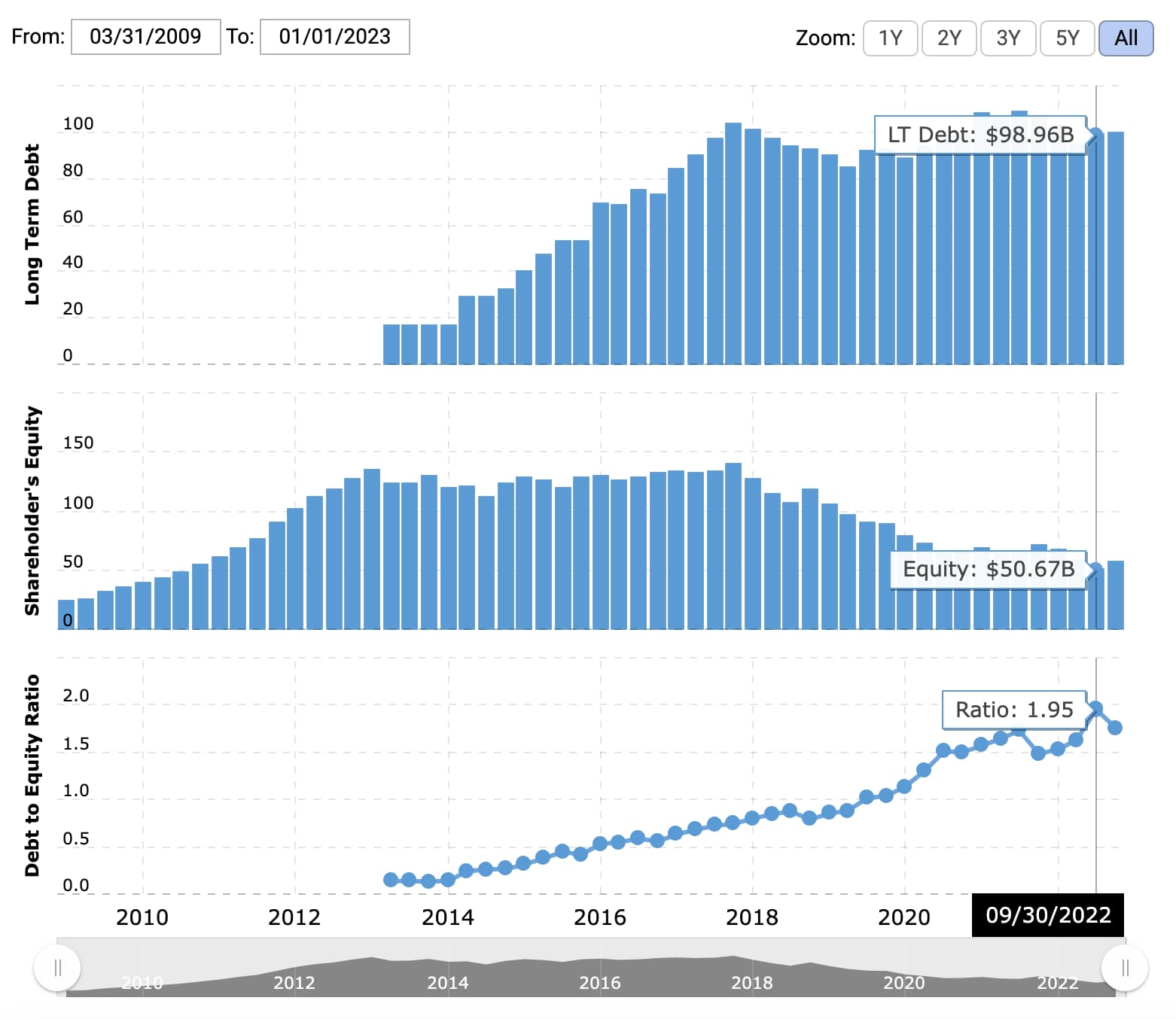

In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations). For example, a prospective mortgage borrower is more likely to be able to continue making payments during a period of extended unemployment if they have more assets than debt. This is also true for an individual applying for a small business loan or a line of credit. How frequently a company should analyze its debt-to-equity ratio varies from company to company, but generally, companies report D/E ratios in their quarterly and annual financial statements. They may monitor D/E ratios more frequently, even monthly, to identify potential trends or issues.

- A steadily rising D/E ratio may make it harder for a company to obtain financing in the future.

- Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock.

- The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities.

- This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used.

The Debt-to-Equity Ratio Formula

For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures. In the financial industry (particularly banking), a similar concept is equity to total assets (or equity to risk-weighted assets), otherwise known as capital adequacy. Gearing ratios are financial ratios that indicate how a company is using its leverage. Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock.

Calculation of Debt To Equity Ratio: Example 1

Some industries, like the banking and financial services sector, have relatively high D/E ratios and that doesn’t mean the companies are in financial distress. “Ratios over 2.0 are generally considered risky, whereas a ratio of 1.0 is considered safe.” A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans.

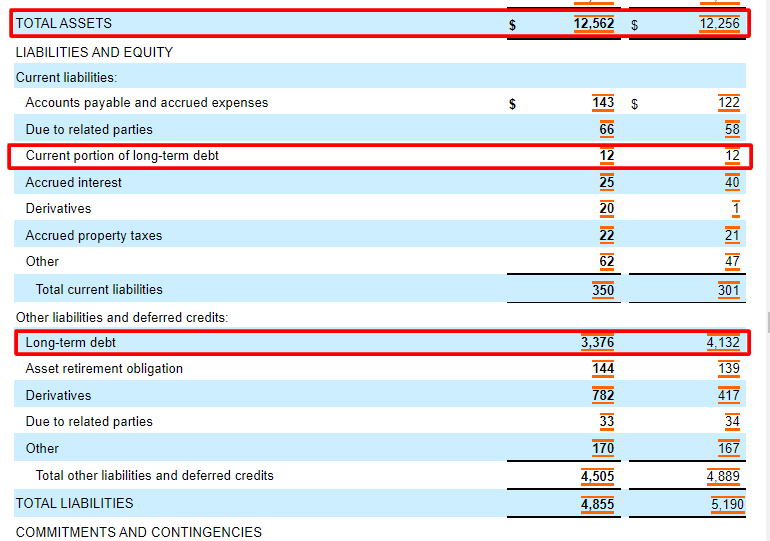

Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18. Current liabilities are the debts that a company will typically pay off within the year, including accounts payable. The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account. Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio.

How to calculate the debt-to-equity ratio

These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor. Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1). The general consensus is that most companies should have a D/E ratio that does not exceed 2 because a ratio higher than this means they are getting more than two-thirds of their capital financing from debt. Below is an overview of the debt-to-equity ratio, including how to calculate and use it. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score.

As an individual investor you may choose to take an active or passive approach to investing and building a nest egg. The approach investors choose may depend on their goals and personal preferences. A company’s accounting policies can change the calculation of its debt-to-equity.

Conversely, a debt level of 40% may be easily manageable for a company in a sector such as utilities, where cash flows are stable and higher debt ratios are the norm. This is because ideal debt to equity ratios will vary from one industry to another. For instance, in capital intensive industries like manufacturing, debt financing is almost always necessary to help a business grow and generate more profits. A high debt to equity ratio means that the company is highly leveraged, which in turn puts it at a higher risk of bankruptcy in the event of a decline in business or an economic downturn. A company’s debt to equity ratio provides investors with an easy way to gauge the company’s financial health and its capital infrastructure.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.